In a world of digital finance where digital payments often meant credit cards and complex bank transfers, India’s system of digital payments sparked a revolution that has reshaped its entire economy, starting from the ground up. The hero of this story is the Unified Payments Interface, or UPI. But what is UPI, and how did it manage to bring millions of street vendors—many of whom had never used a bank before—into the digital age?

UPI Digital Payments have become a vital component of the Indian economy, showcasing how technology can enhance everyday transactions and foster economic growth.

As more people engage with digital payments, it is clear that this system is not merely a trend but a transformative force in the financial landscape.

This isn’t just a story about technology; it’s a story of empowerment, inclusion, and India’s journey to becoming a digital powerhouse.

As UPI Digital Payments continue to grow, they are not just changing the economy but also the way people view transactions.

Before UPI: A World of Cash and Complications

The rise of UPI Digital Payments has led to greater transparency and accountability in transactions, empowering both consumers and vendors alike.

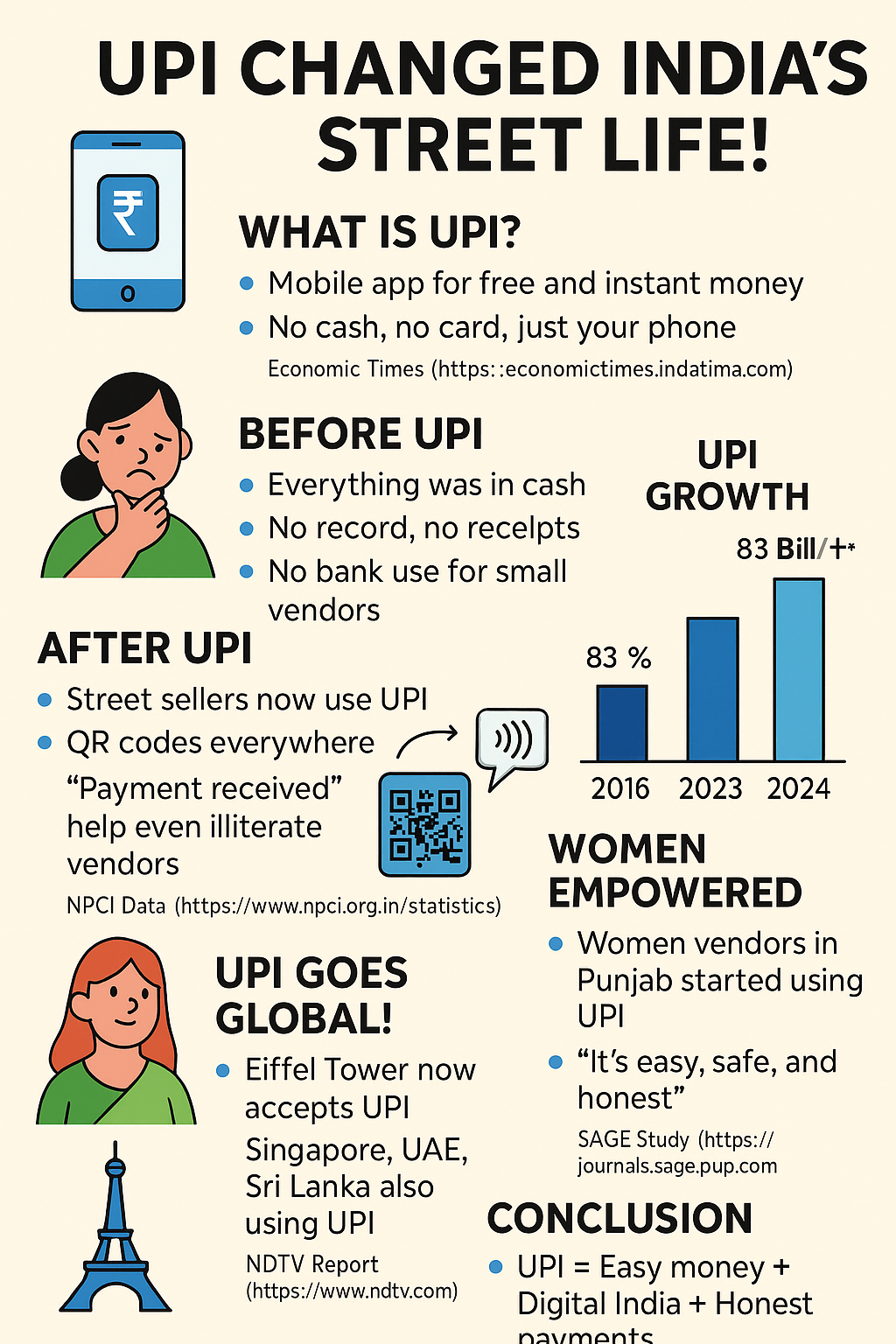

Just a few years ago, India’s bustling street markets ran almost entirely on cash. From your morning cup of chai to your evening vegetables, every transaction involved a frantic search for exact change. For small vendors, this cash-driven economy presented daily challenges: there were no records of transactions, no receipts, and little to no interaction with formal banking systems, making it nearly impossible to get loans or grow financially. Official reports, including those from the World Bank, have long highlighted this gap in financial inclusion.

The UPI Effect: How Digital Payments Put a QR Code on Every Corner

This rapid adoption of digital payments has not only facilitated easier transactions but has also encouraged financial literacy among the populace.

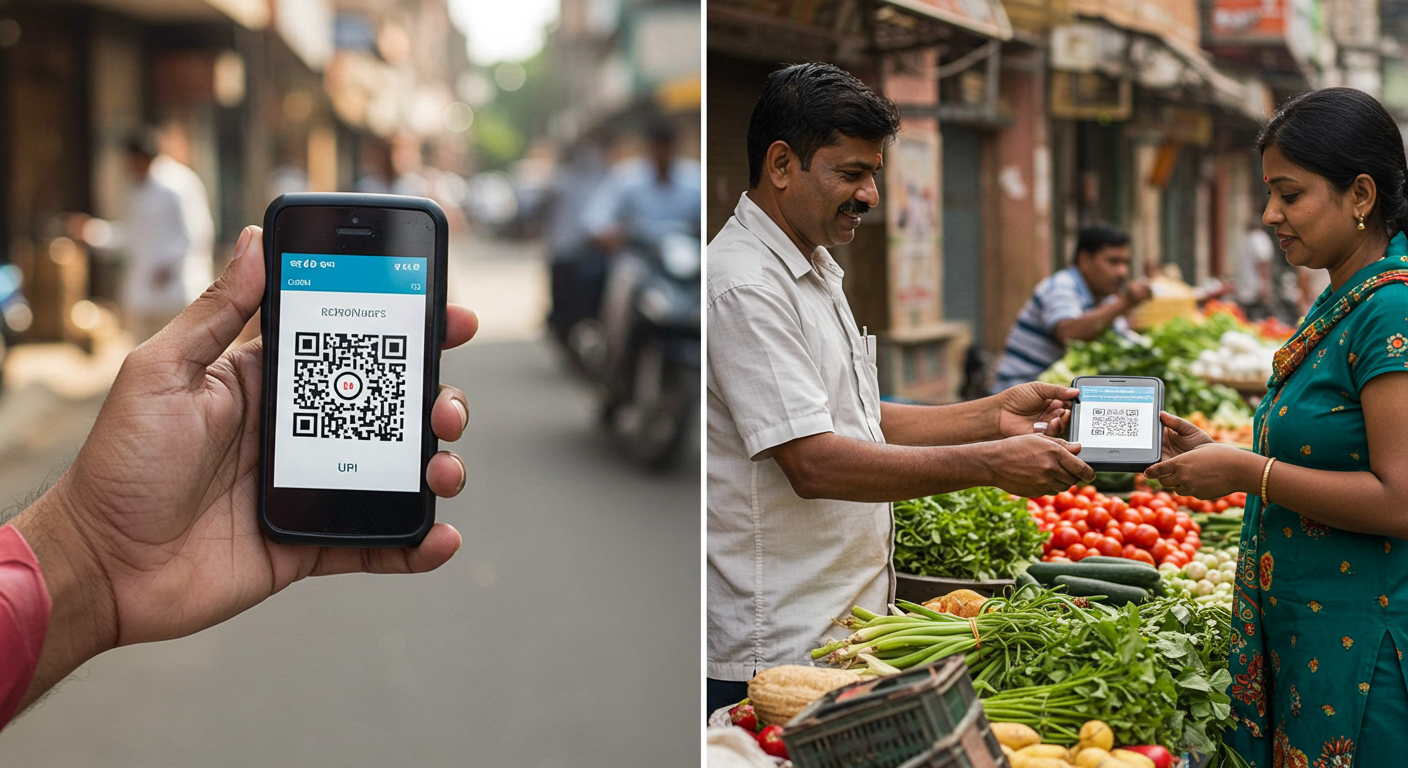

Walk down any Indian street today, and you’ll see a universal sight: simple black-and-white QR codes hanging from vegetable carts, tea stalls, and small artisan shops. This is the visible impact of UPI technology.

The change has been monumental. According to official data from the National Payments Corporation of India (NPCI), UPI transactions have seen explosive growth, making up a staggering 83% of all digital payments in India by early 2024.

As UPI Digital Payments gain momentum, they are being adopted across various sectors, further solidifying their role in the economy.

UPI Digital Payments have made everyday transactions simpler and more secure for millions of users across India.

With the advent of digital payments, countless stories have emerged demonstrating its transformative power in everyday life.

For street vendors, the transition was seamless. Many now use voice-enabled payment boxes that announce transactions out loud (“Payment of ten rupees received”), building trust for even non-literate shopkeepers. This simple innovation, as reported at its launch, was a game-changer in bridging the technology-trust gap.

Empowering the Underserved: The Human Stories

Beyond the data, the true power of UPI lies in its human impact.

- Women’s Empowerment: A research study on women street vendors in Phagwara, Punjab, revealed a powerful trend. Women aged 40-50, who had previously only dealt in cash, were now confidently using UPI for their daily business. They cited its ease of use, safety from theft, and the ability to track their earnings as major benefits.

- Surviving the Pandemic: The COVID-19 pandemic accelerated this shift. As contactless payments became a necessity for safety, vendors across the country adapted rapidly. A Livemint study noted that in tech hubs like Bengaluru, nearly half of all street vendors adopted UPI to keep their businesses alive.

As countries observe the success of UPI Digital Payments, they are inspired to create their own systems to improve financial inclusivity.

A Global Benchmark: Why the World is Watching UPI

While the US has popular payment apps like Zelle and Venmo, they primarily focus on person-to-person payments and are often tied to specific banks. UPI’s genius lies in its universality—it is a public utility that connects all banks and all payment apps on a single, real-time platform with zero fees for small transactions. This model, as Forbes and other international publications have noted, is far more inclusive and scalable.

This success has not gone unnoticed. Inspired by UPI, countries are now building their own real-time payment systems.

- Brazil developed PIX.

- The United States launched FedNow.

- France, Singapore, UAE, and Sri Lanka have partnered with India, with UPI now even accepted at Paris’s Eiffel Tower.

As an IMF blog on the topic suggests, India’s real-time payment infrastructure has set a new global standard.

Conclusion: More Than Just Money

Ultimately, UPI Digital Payments represent a shift towards a more connected and efficient economy, showcasing the power of innovation in addressing financial barriers.

Through UPI Digital Payments, India has set a benchmark for the world, demonstrating the potential that lies in digital transactions.

UPI is not just another payment app; it’s a symbol of India’s digital transformation. It has empowered the smallest of entrepreneurs, brought millions into the formal economy, and showcased to the world how home-grown technology can solve real-world problems at an unprecedented scale.

From the bustling streets of Varanasi to the iconic Eiffel Tower, this Indian innovation is quietly changing the world, one transaction at a time.

Furthermore, UPI Digital Payments have also paved the way for a new era of financial inclusion.